- +968 93202874

- info@mail.com

- Sultnate of Oman

What We Do

A portal for consolidation of your financial data that organizes, and integrates financial information provided by you into one unified dashboard. This helps individuals manage their finances in one place and make better decisions based on all available data.

Our financial data consolidation portal offers a comprehensive, user-friendly platform to integrate and manage your financial information in one location.

With our financial consolidation portal, you can effortlessly aggregate data from multiple accounts, giving you a complete overview of your financial situation in real-time which is designed to save you time and provide clarity

Disclaimer:

We take no responsibility for any incorrect information or misuse of data in any manner whatsoever. The data visible on this dashboard shall be exclusively provided by you in your own interest and own responsibility. We urge you NOT to provide your Name, Bank account details and any other sensitive information whatsoever for your own security

Wealth Creation & Financial Literacy

Disclaimer: The contents below sited are exclusively meant for education and information purposes only which must not be misinterpreted and misused. We do not provide any recomendations and advises on your investments.

Wealth creation

Wealth creation can be defined as the process of building up assets and financial resources over time. It involves strategies like saving, investing, and generating income to increase one’s overall net worth.

Key aspects of wealth creation include disciplined financial habits, understanding investment opportunities, and consistently working towards long-term financial goals.

What is an Investment ?

An investment is an asset or property acquired to generate income or gain appreciation. Appreciation is the increase in the value of an asset over time. It requires the outlay of a resource today, like time, effort, and money, for a greater payoff in the future or for generating a profit.

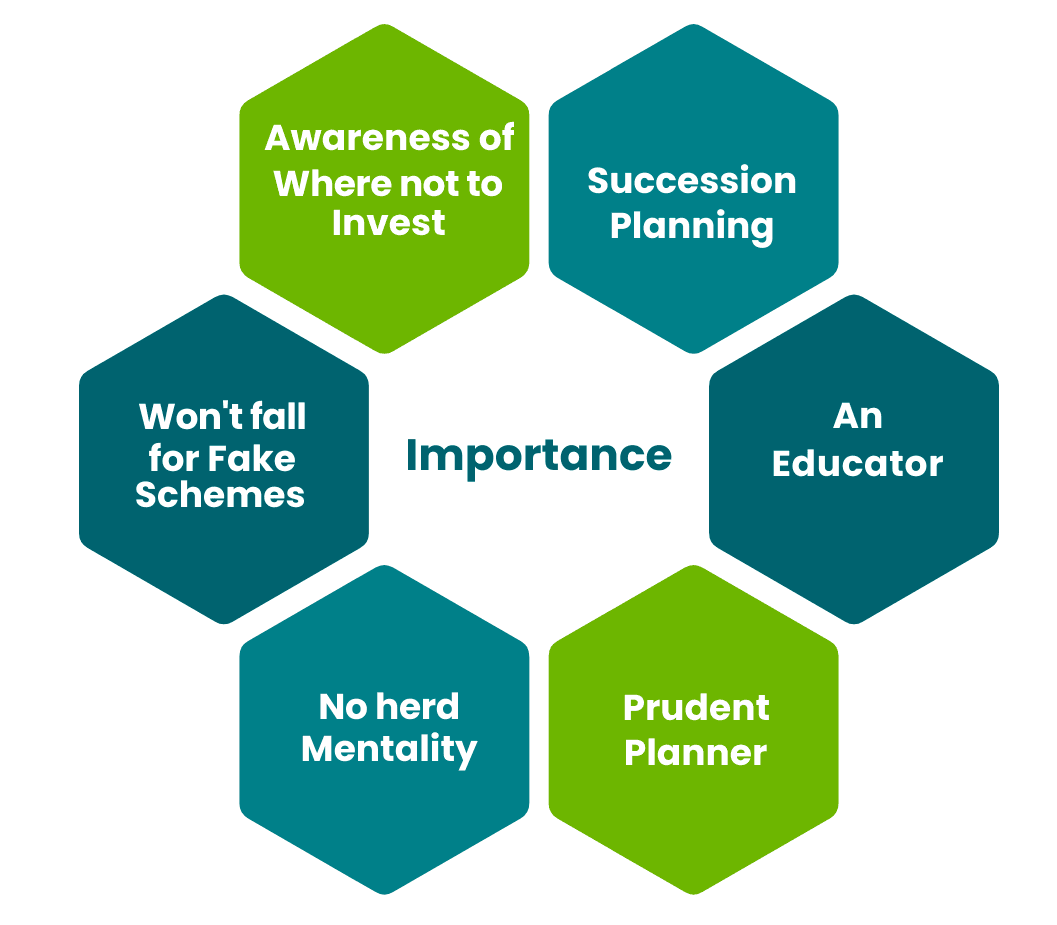

Financial Literacy

Financial literacy is the possession of skills, knowledge, and behaviors that allow an individual to make informed decisions regarding money. Financial literacy, financial education and financial knowledge are used interchangeably.

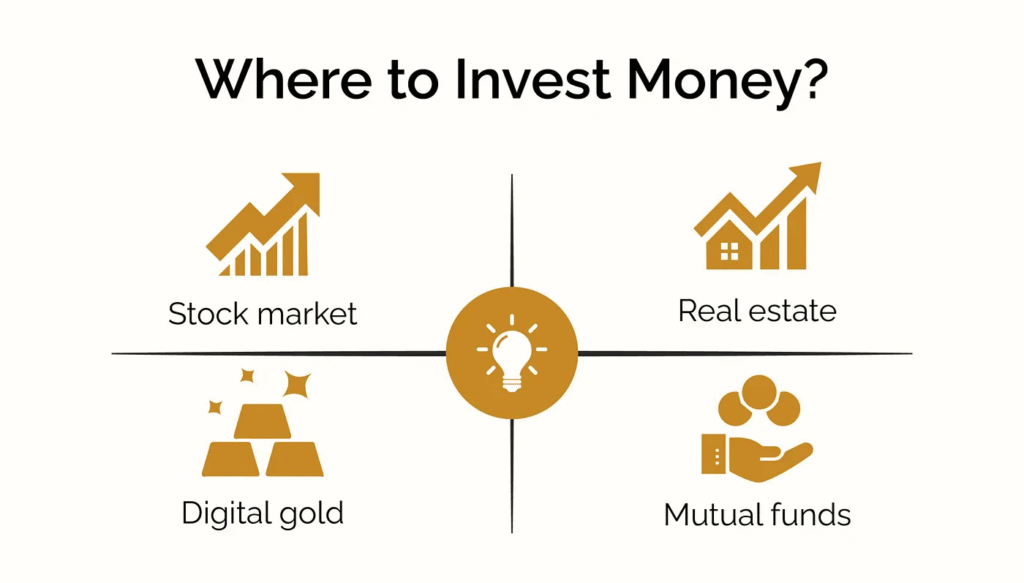

Where to Invest ?

Where should i invest my money?

A very common question one asks himself…..

Stock Market

Wealth creation through the stock market isn’t about chasing the next big thing or copying what everyone else is doing. It’s about building consistency, mastering your psychology, and developing a system that works for you.

Wealth creation through the stock market isn’t about chasing the next big thing or copying what everyone else is doing. It’s about building consistency, mastering your psychology, and developing a system that works for you.

Stocks or Equities

A share of stock is a piece of ownership of a public or private company. The investor may be entitled to dividend distributions generated from the company's net profit. The stock's value can also grow and be sold for capital gains. The two primary types of stocks to invest in are common and preferred.

Index Funds or Mutual Funds

Index and mutual funds aggregate specific investments to craft one investment vehicle. An investor can buy shares of a single mutual fund that owns shares of multiple companies. Mutual funds are actively managed while index funds are often passively managed. Actively-managed funds use investment professionals to outperform an index or try to beat a specific benchmark. In contrast, passively-managed funds attempt to imitate a benchmark by mirroring the stocks listed on the index

Bonds or Fixed-Income Securities

An investment that often demands an upfront investment and pays recurring interest over time, called a coupon payment. At maturity, the investor receives the capital invested into the bond. Like debt, bond investments are a mechanism for governments and companies to raise money.

Other Investments

Digital Gold Real Estate: Real estate investments are investments in physical, tangible spaces that can be utilized. Land can be built on, office buildings can be occupied, warehouses can store inventory, and residential properties can house families. Real estate investments may encompass acquiring sites, developing sites for specific uses, or purchasing ready-to-occupy operating sites. Commodities: Raw materials such as agriculture, energy, or metals are commodities. Investors can invest in tangible commodities, like owning a bar of gold, or choose alternative investment products that represent digital ownership, such as a gold ETF. Oil and gas are examples of commodities.

What our clients say

.....

Connect with us

....

Address

Post Box

Phone

+968-93202874

+968 9.............4

Email Address

myemail@mail.com

info@mail.com

Business Hours

MON to FRI: 8AMto 6PM

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Journey Towards Success

FINANCIAL

- +968 93202874

- info@mail.com

- Sultanate of Oman